Nvidia vs AMD: Which is the Better AI Stock for 2025?

Nvidia (NVDA 2.63%) has become the dominant player in the data center computing market, a crucial space for artificial intelligence (AI) development. This dominance is largely due to its CUDA software, which has become the industry standard for AI-related computations. While AMD (AMD 1.15%) offers competitive GPUs, it faces a significant challenge in overcoming Nvidia’s established ecosystem. This article analyzes the strengths and weaknesses of both companies to determine which is the better AI stock for 2025.

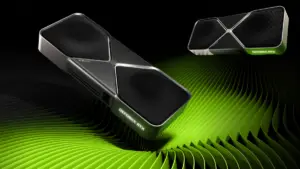

Nvidia’s Dominance and Moat

Nvidia’s GPUs and CUDA software have become essential tools for data centers powering AI. The widespread adoption of CUDA creates a significant barrier to entry for competitors like AMD. Switching to a different platform requires substantial investment and disruption, making it difficult for AMD to gain significant market share.

This dominance is reflected in their financial performance. While AMD’s data center revenue is growing impressively (e.g., $3.9 billion in Q4 2024, up 69% year over year), it pales in comparison to Nvidia’s. In Q3 FY2025, Nvidia’s data center revenue reached a staggering $30.8 billion, a 112% year-over-year increase. This indicates Nvidia’s data center business is roughly ten times the size of AMD’s.

Valuation and Growth Prospects

While Nvidia holds a commanding lead, AMD’s stock might appear more attractive if it trades at a significant discount. However, a direct comparison of price-to-earnings (P/E) ratios reveals that AMD’s stock is currently more expensive than Nvidia’s. Even when considering forward P/E ratios, which account for future growth, AMD appears cheaper, but this difference aligns with their respective growth projections. Nvidia’s revenue is expected to grow by 52% in FY2026, while AMD’s growth is projected at 24%.

Investment Recommendation

Given Nvidia’s dominant market position, superior growth prospects, and established ecosystem, it appears to be the stronger AI stock for 2025. While AMD is a capable competitor, its smaller market share and less established software ecosystem make it a less compelling investment compared to Nvidia. Best-in-class companies often outperform their peers, especially when starting from similar valuation points.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consult with a financial advisor before making any investment decisions. The Motley Fool’s Stock Advisor recommendations are mentioned for illustrative purposes only and do not represent a guarantee of future returns. Past performance is not indicative of future results.